is property tax included in mortgage ontario

Hey all been a while since Ive posted but keep reading and learning. This is often a default measure used to.

Paying Off Your Mortgage The Property Taxes And Homeowners Insurance Are Now On You The Washington Post

Norfolk County Property Tax.

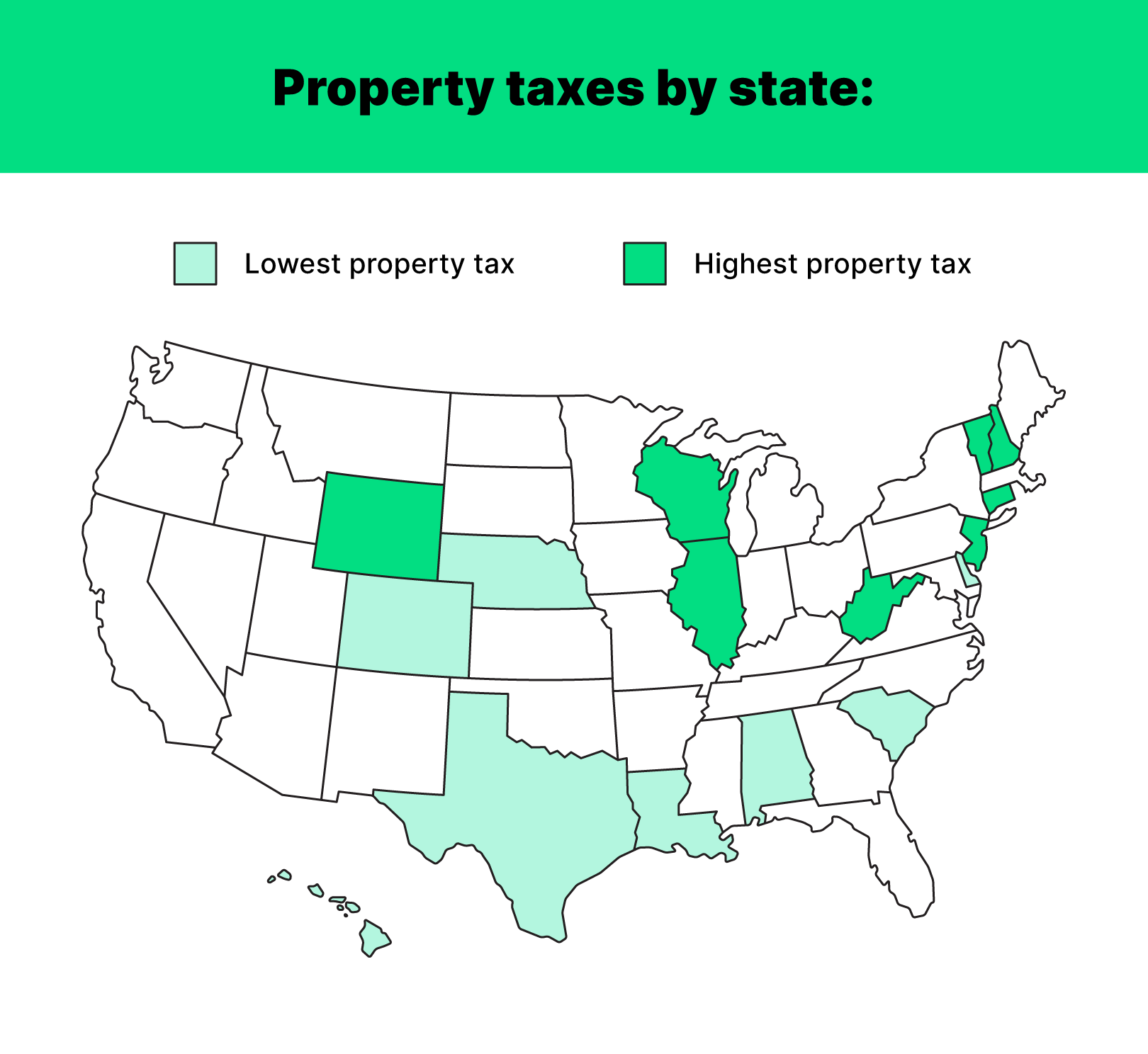

. Paying Your Property Taxes In Various Ways If you choose to make your payments through your mortgage the payments for your property taxes will be incorporated into your. That means youd have to pay 250 per month. Toronto had the lowest property tax rate in 2021 at 061 per cent followed by Markham at 063 per cent.

With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax. For example a Toronto homeowner with a property valued at 500000 would pay 305507 in property taxes based on the citys rate of 0611013 the lowest on the list. The rates for the municipal portion of the tax are established by each municipality.

In a two-tiered municipality a. If you qualify for a 50000. Want to see what homeowners across ontario pay in property taxes on homes assessed at 250000.

Costs included in a mortgage payment Principal. A municipal portion and an education portion. The money collected from this tax goes toward a variety of services including public or.

Hey all been a while since Ive posted but keep reading and. Property tax rates vary by region and are based on assessments that determine the market value of land or a building. So our mortgage with BMO includes the property tax component approx 95biweekly payment and this has recently.

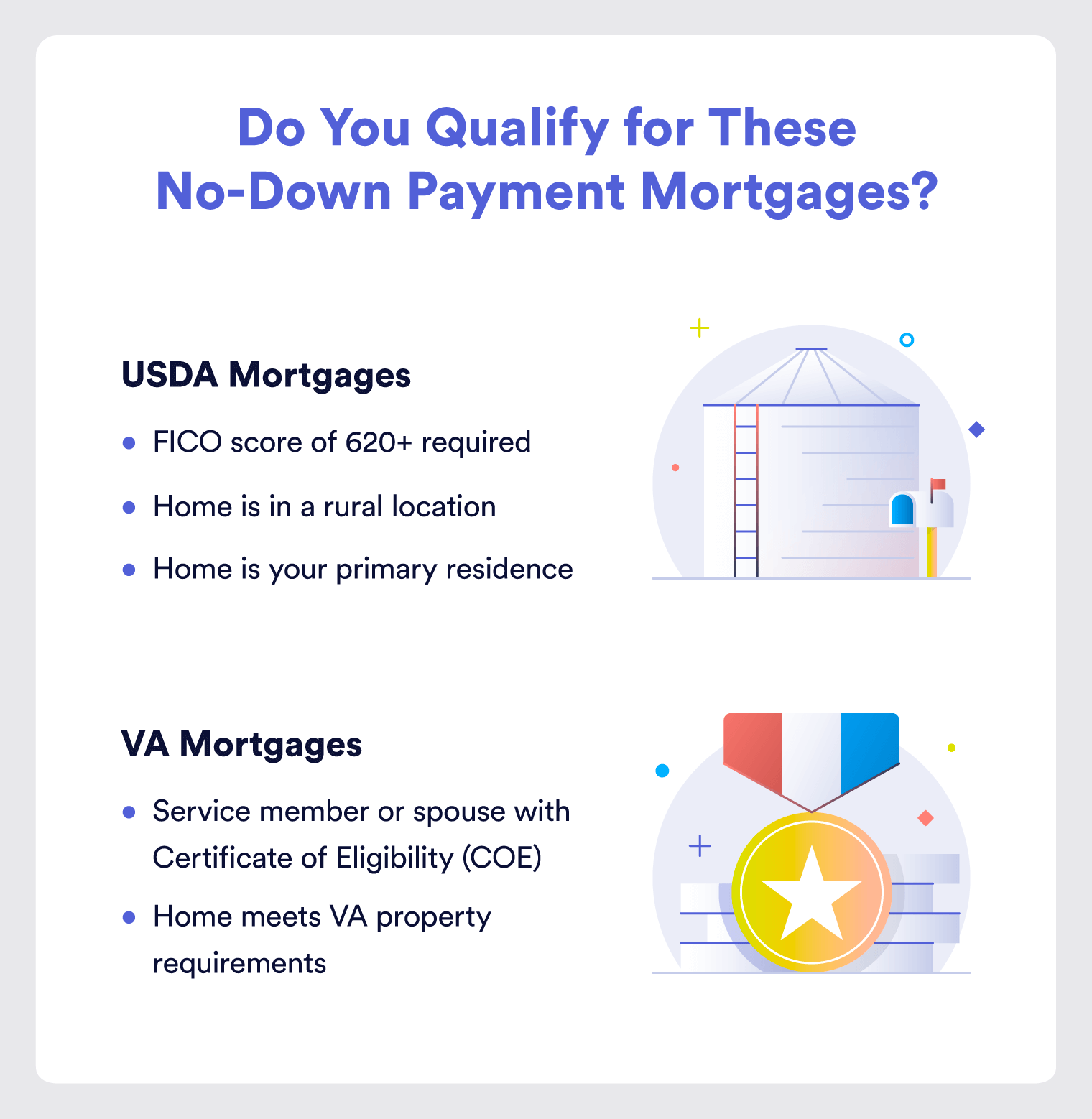

Contact your mortgage lender to set up tax payments to be included with your mortgage. For example someone who owns a. In most cases property taxes are included in your mortgage payment and your lender pays them to the municipality on your behalf.

Property tax has two components. If you own a home you have to pay yearly property taxes to the municipality you live in. When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount.

If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Only the interest portion of the. Whichever option you decide upon will be a personal choice that suits your own needs and lifestyle though typically most homeowners will pay their property taxes through.

To illustrate lets say your annual property taxes are estimated at 3000 and you pay your mortgage in monthly installments. The MCAP Property Tax Service is complimentary for all our mortgage holders. Some lenders also require you to pay your property tax through your mortgage if you are a first-time homebuyer.

The logic behind this decision is that because you are a new. The mortgage the homebuyer pays one year can increase the. Lenders often roll property taxes into.

Property taxes mortgage payments utilities and more the list of expenses for your home can be overwhelming and property taxes might seem like a cost you can skip if youre.

:max_bytes(150000):strip_icc()/whats-difference-between-renters-insurance-and-homeowners-insurance-v2-2694bc76e944405aa55fe2784c373999.png)

Homeowners Insurance Vs Renter S Insurance What S The Difference

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Your Guide To Property Taxes Hippo

Your Guide To Property Taxes Hippo

How To Estimate Closing Costs Assurance Financial

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Claiming Property Taxes On Your Tax Return Turbotax Tax Tips Videos

Are Property Taxes Included In Mortgage Payments Smartasset

How To Lower Property Taxes 7 Tips Quicken Loans

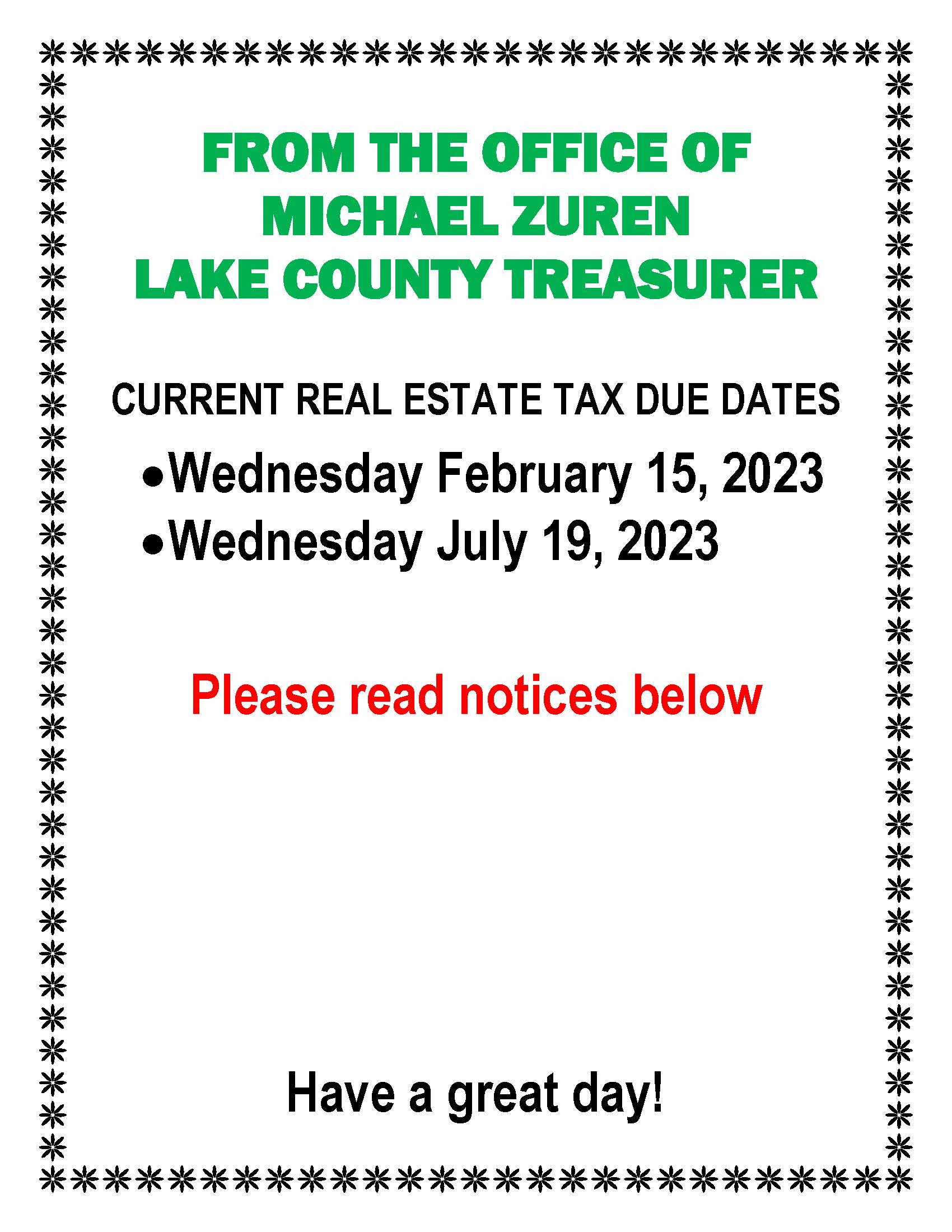

Property Tax Due Dates Treasurer

Paying Property Tax In Canada Nerdwallet

Paying Property Tax In Canada Nerdwallet

Mutual Pay Pay Your Mortgage Mutual Of Omaha Mortgage

The Importance Of Debt To Income Ratio For Investment Property

Paying Property Tax In Canada Nerdwallet

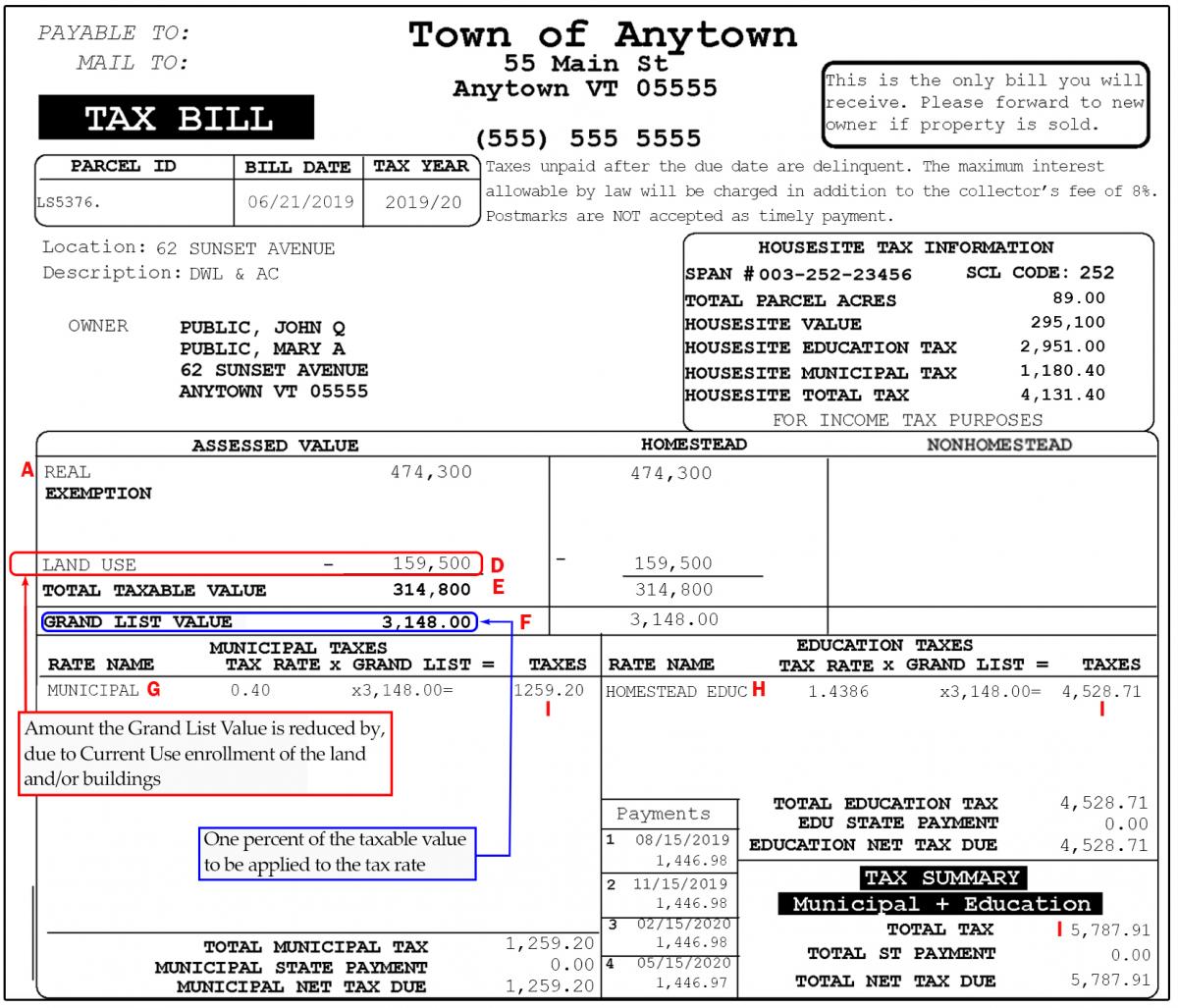

Current Use And Your Property Tax Bill Department Of Taxes

What S Included In A Monthly Mortgage Payment Ramsey

Mortgage Interest Deduction What You Need To Know Mortgage Professional